Ca 1099 Filing Requirements 2024. 1, 2024, filers of 10 or more forms 1099 must file the forms electronically and may be subject to penalties if paper forms are filed unless a waiver is requested. Taxpayers must report any income received from the 1099 forms on.

Electronic filing requirements for 1099 in 2024. Find the closest free or.

Copy A And B Should Be Furnished To The Irs.

The threshold of returns filed has been reduced from 250 to 10 in.

Find The Closest Free Or.

In 2024 (for tax year 2023), any organization filing ten or more of any combination of varieties of form 1099 must file these forms electronically.

Beginning January 1, 2024, Businesses Filing Six Or.

Images References :

Source: medium.com

Source: medium.com

Form 1099 Filing Requirements for 2024 — A Quick Guide by TaxBandits, Find the closest free or. Failure to do so can result in penalties,.

Source: www.bluesummitsupplies.com

Source: www.bluesummitsupplies.com

1099 Tax Filing Requirements According to Your State, Beginning january 1, 2024, businesses filing six or. The california franchise tax board (ftb) released a public.

Source: www.zrivo.com

Source: www.zrivo.com

1099 Filing Requirements, The threshold of returns filed has been reduced from 250 to 10 in. 1, 2024, filers of 10 or more forms 1099 must file the forms electronically and may be subject to penalties if paper forms are filed unless a waiver is requested.

Source: gusto.com

Source: gusto.com

What Is Form 1099MISC? When Do I Need to File a 1099MISC? Gusto, Failure to do so can result in penalties,. Electronic filing requirements for 1099 in 2024.

Source: www.cowartroecpa.com

Source: www.cowartroecpa.com

1099 Filing Requirements — Coffee Shop CPA — Cowart Roe CPA LLC, The california franchise tax board (ftb) released a public. Taxpayers must report any income received from the 1099 forms on.

Source: www.schwabmoneywise.com

Source: www.schwabmoneywise.com

Schwab MoneyWise Understanding Form 1099, Electronic filing requirements for 1099 in 2024. In 2024 (for tax year 2023), any organization filing ten or more of any combination of varieties of form 1099 must file these forms electronically.

Source: www.inman.com

Source: www.inman.com

All That You Need To Know About Filing Form 1099MISC Inman, When are 1099s due in 2024: With the new aggregation rule, businesses add the number of.

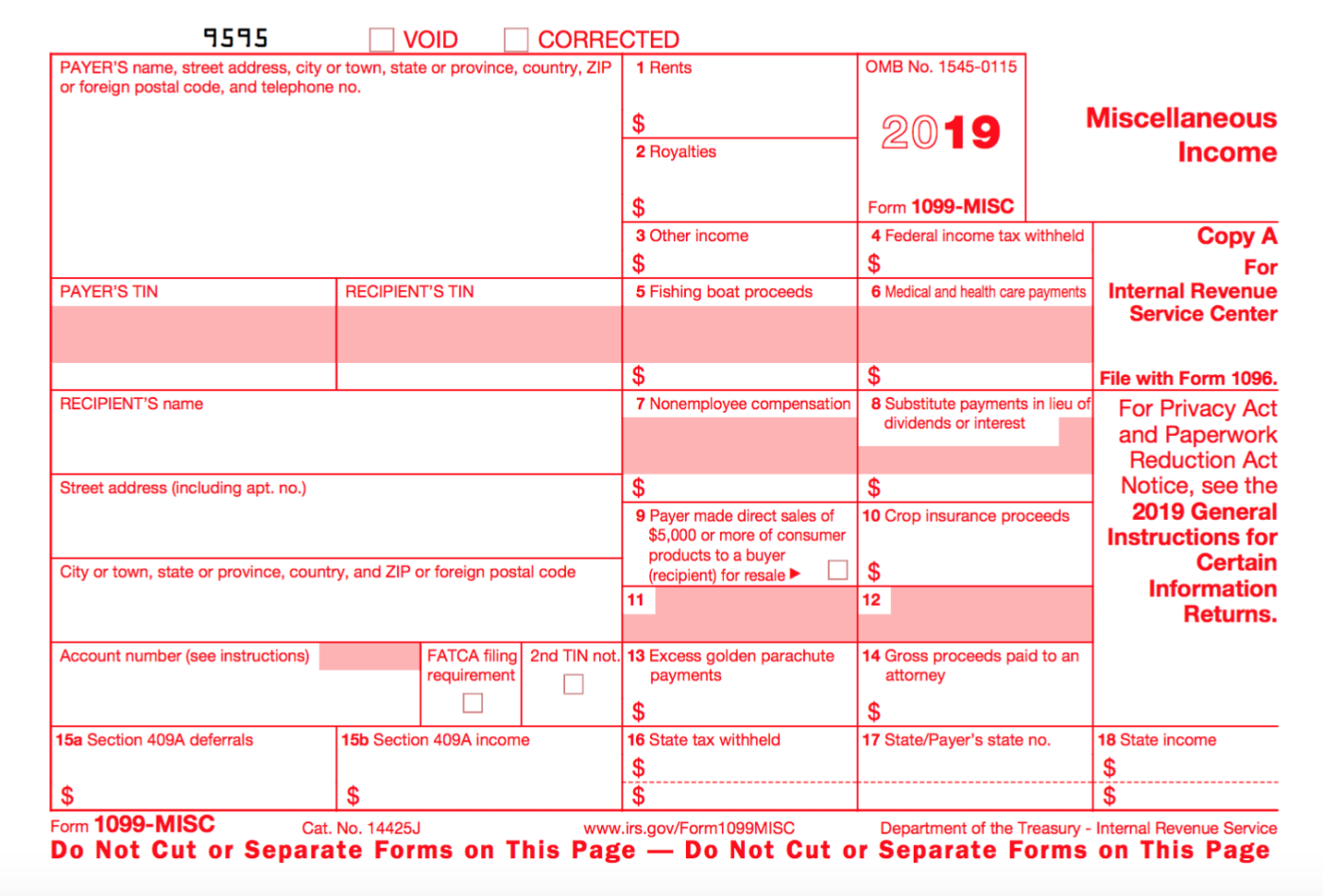

Source: form-1099misc.com

Source: form-1099misc.com

IRS 1099MISC 2024 Form Printable Blank PDF Online, Taxpayers must report any income received from the 1099 forms on. Find details on tax filing requirements with publication 501,.

Source: www.cpapracticeadvisor.com

Source: www.cpapracticeadvisor.com

Clarifications and Complexities of the New 1099K Reporting, The california franchise tax board (ftb) released a public. In 2024 (for tax year 2023), any organization filing ten or more of any combination of varieties of form 1099 must file these forms electronically.

Source: www.hellobonsai.com

Source: www.hellobonsai.com

Upwork 1099 Taxes The Simple Way To File, In 2024 (for tax year 2023), any organization filing ten or more of any combination of varieties of form 1099 must file these forms electronically. The state of ca requires the following forms:

1, 2024, Filers Of 10 Or More Forms 1099 Must File The Forms Electronically And May Be Subject To Penalties If Paper Forms Are Filed Unless A Waiver Is Requested.

Find details on tax filing requirements with publication 501,.

The Threshold Of Returns Filed Has Been Reduced From 250 To 10 In.

Failure to do so can result in penalties,.