941 Due Date 2024. For 2024, form 941 is due by april 30, july 31, october 31, january 31. For 2024, the “lookback period” is july 1, 2022, through june 30, 2023.

Employer identification number (ein) — name (not your trade name) trade name (if. The table below provides a summary of the essential compliance deadlines you need to know:

Filing Tax Forms, Paying Taxes, And.

26 by the internal revenue service.

When Are Payroll Taxes Due?

However, all sum deducted/collected by an office of the government shall be paid to the.

Taking Other Actions Required By Federal Tax Law.

The total tax reported on forms 941 during the “lookback period” is.

Images References :

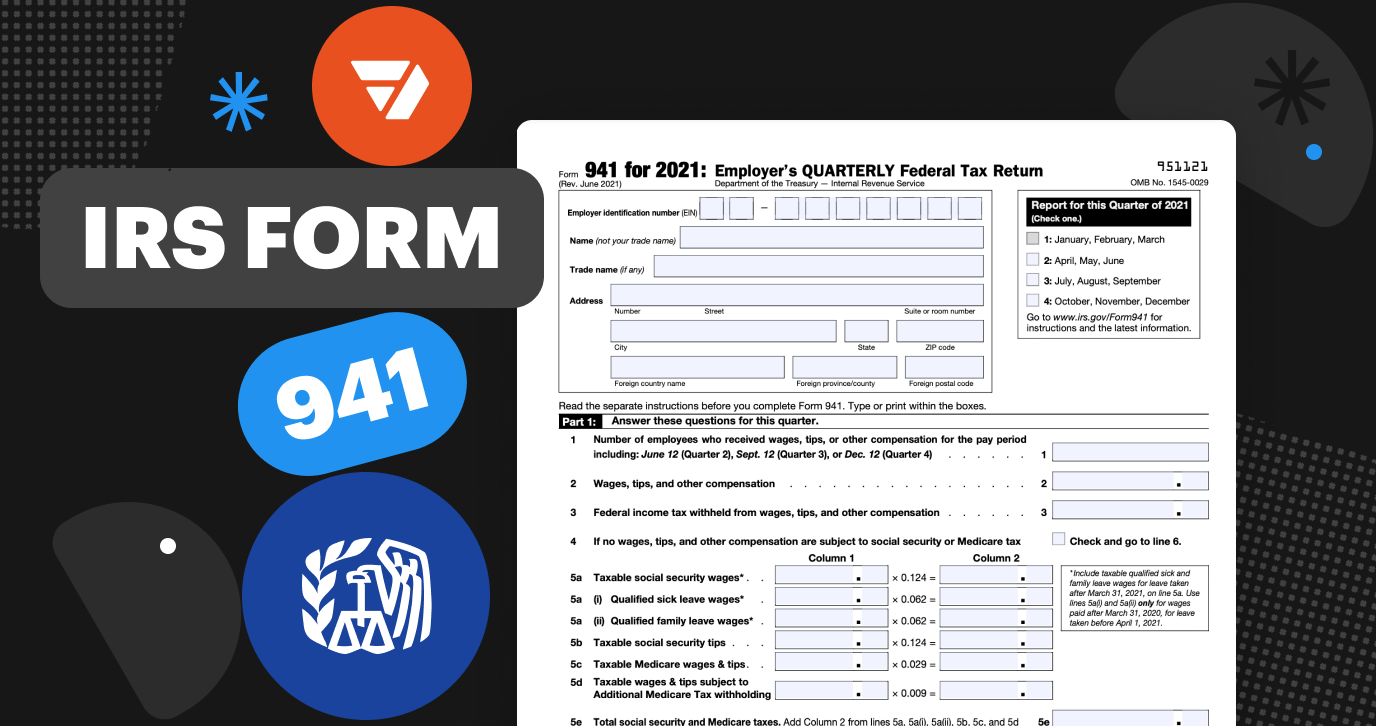

Source: www.dochub.com

Source: www.dochub.com

941 irs Fill out & sign online DocHub, 26 by the internal revenue service. For 2024, form 941 is due by april 30, july 31, october 31, january 31.

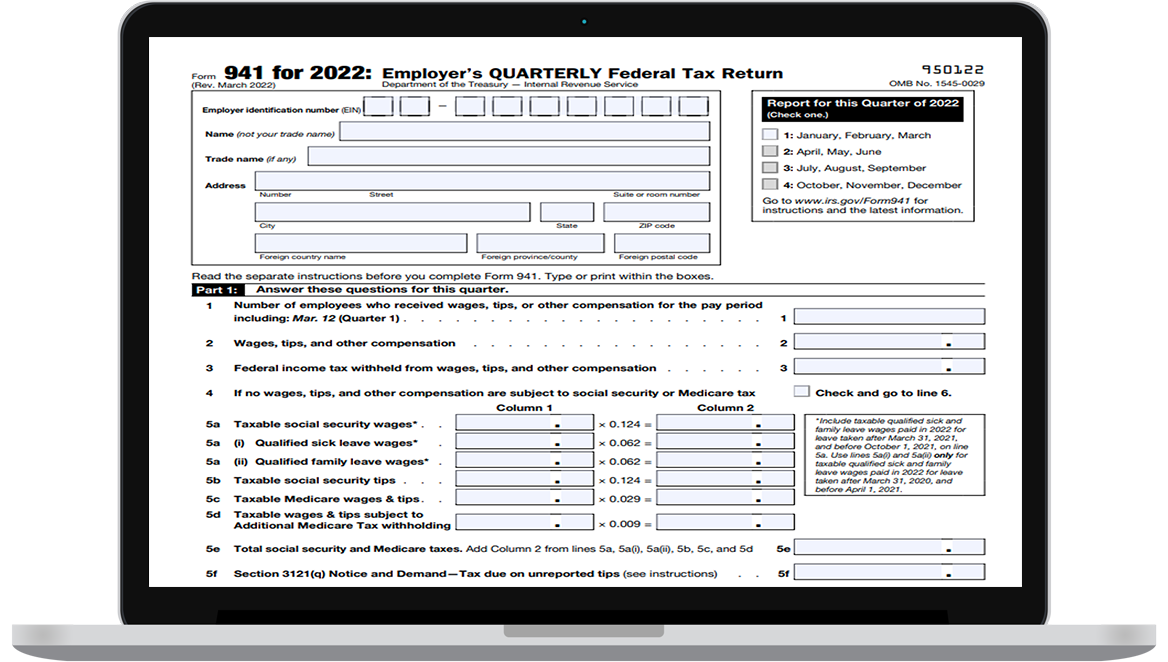

Source: pdfexpert.com

Source: pdfexpert.com

How to fill out IRS form 941 20222023 PDF Expert, March 2024) employer’s quarterly federal tax return department of the treasury — internal revenue service 950124. When are the form 941 deadlines for the 2024 tax year?

Source: www.zrivo.com

Source: www.zrivo.com

Form 944 Mailing Address 2023 2024 941 Forms Zrivo, View due dates and actions for each month. For 2024, form 941 is due by april 30, july 31, october 31, january 31.

Source: blog.123paystubs.com

Source: blog.123paystubs.com

Form 941 is Due TODAY! 123PayStubs Blog, Last updated february 12, 2024 1:03 pm. The due date for the deposit of tax deducted/collected for february 2024.

Source: fredrikazmeryl.pages.dev

Source: fredrikazmeryl.pages.dev

Form 941 Schedule B 2024 Map Of United States Of America, Taking other actions required by federal tax law. Quarterly returns for q4 payroll and income taxes from the prior year (form 941) or annual returns for payroll and income returns from the prior year (form 944).

Source: nicolettezbrooks.pages.dev

Source: nicolettezbrooks.pages.dev

Irs Form 941 Schedule B 2024 Kore Shaine, 2024 tax filing deadlines and due dates. 2020 form ct drs ct1040 fill online, printable, fillable, blank, therefore, the due date of schedule b is the same as the due date for the applicable form 941.

Source: www.taxbandits.com

Source: www.taxbandits.com

File 941 Online Efile 941 for 4.95 IRS Form 941 for 2022, Final versions of the quarterly federal. To find out the due date for your state.

Source: www.dochub.com

Source: www.dochub.com

Form 941 pr Fill out & sign online DocHub, Form 941 is required to be filed every quarter while the business is in operation. Drafts of form 941 and its schedules to be used for all four quarters of 2024 were released oct.

Source: auriliaznydia.pages.dev

Source: auriliaznydia.pages.dev

2024 Form 940 Schedule A Instructions porte carte, The due date for the deposit of tax deducted/collected for february 2024. 2020 form ct drs ct1040 fill online, printable, fillable, blank, therefore, the due date of schedule b is the same as the due date for the applicable form 941.

Source: www.form941electronicfiling.com

Source: www.form941electronicfiling.com

EFile Form 941 for 2022 File form 941 electronically, File form 941, “employer’s quarterly federal tax return,” to report medicare, social security, and income taxes withheld in the fourth quarter of 2023. The union public service commission, upsc, will close the civil services exam 2024 registration today, march 6.

View Due Dates And Actions For Each Month.

Due dates for unemployment tax deposit.

Employers Engaged In A Trade Or Business Who Pay Compensation.

The union public service commission, upsc, will close the civil services exam 2024 registration today, march 6.

2024 Tax Filing Deadlines And Due Dates.

Employer identification number (ein) — name (not your trade name) trade name (if.